In order to fulfill the requirement of the Internship program it has chosen Southeast Bank Ltd, Human Resource Division (HRD) of Southeast Bank Ltd placed me to Islamic Banking Branch at Motijheel. The overall topic of the report has been selected by discussion between me and course instructor .The topic of my report is “General banking Activities of Southeast Bank Ltd”.

OBJECTIVE OF THE STUDY

Primary objective:

The primary objective of this report is to familiar with the working environment of present institutions and also fulfill the requirement of BBA theoretical knowledge gained from the coursework of the BBA program in a specific field.

Secondary Objective:

- To Understand and analyze the overall activities of Southeast Bank Limited

- To evaluate the existing activities and techniques of Southeast Bank Limited

- To study the operational efficiency of southeast Bank Limited

- To suggest the ways and means for improvement in policy and techniques

- To relate the theoretical learning with the real life situation

METHODOLOGY OF THE REPORT

The study requires various types of information of present policies, procedures and methods of General Banking Operation. Both primary and secondary data available have been used in preparing this report.

Primary Data sources:

- Practical banking work.

- Personal discussion with the officers and executives of Southeast Bank Limited.

- Personal interview with the customers.

Secondary Data sources:

- Daily diary (containing my activities of practical orientation in Southeast Bank Ltd),

- Various publications on banking operation,

- Website of Bangladesh Bank,

- Website of Southeast Bank Limited,

- Annual Report of the Southeast Bank Ltd,

- Personal investigation with bankers,

- Different circulars issued by Head Office and Bangladesh Bank

ORIGIN OF THE REPORT

The banking world has been undergoing rapid and fundamental changes. The speed of these changes has been maintained even after the global financial turmoil experienced during the past few years. It is well recognized that there is an urgent need for better-qualified management and better-trained staff in the dynamic global financial market. Bangladesh is no exception of this trend. Bank education is a practice-oriented education and Banking Sector in Bangladesh is facing challenges from different angles though its prospect is bright in the future. The objective of the 3 month Internship to develop the specific skills and the breadth of judgment required of effective financial executives or bankers. To growing up my knowledge, I was sent to SOUTHEAST BANK LIMITED Motijheel Branch (Islamic Banking) from 6th June, 2013 to 6th September, 2013. This Report has been prepared on the basis of my practical experiences on the day-to-day banking activities and under the close supervision of my Organizational Supervisor Mahfuzur Rahman and close guidance of Head of Branch Saiful Islam Chowdhury.

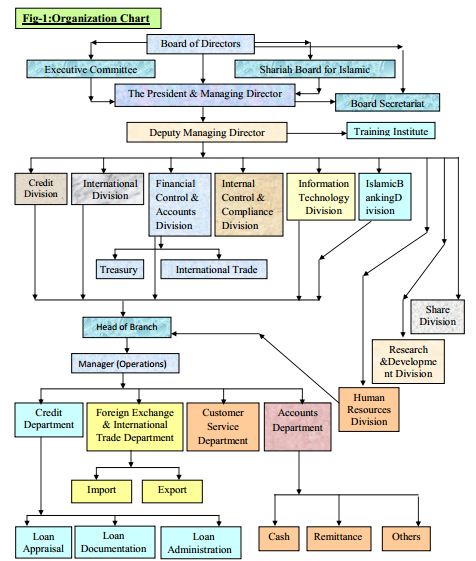

ORGANIZATION CHART

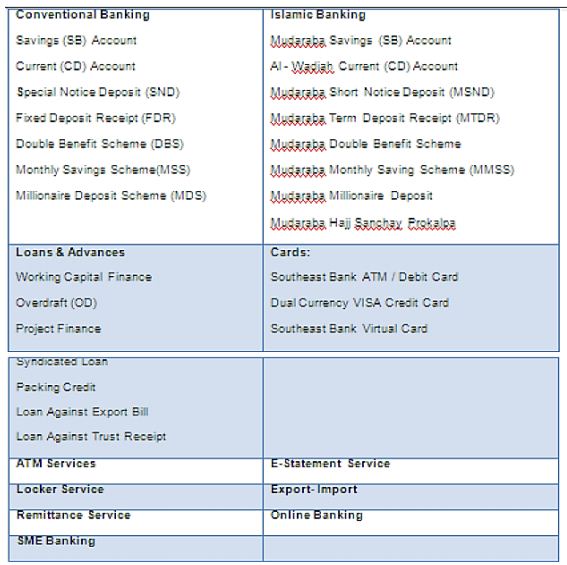

Product & Services of SEBL

PROJECT PART

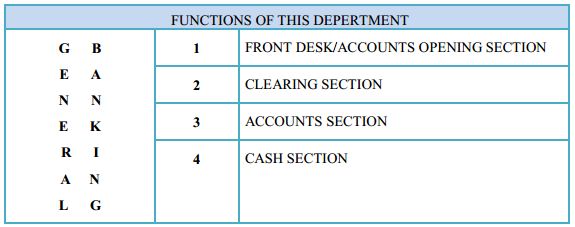

GENERAL BANKING ACTIVITIES:

General banking is the starting point of all the banking operations. It is the department, which provides day-to-day services to the customers. Every day it receives deposits from the customers and meets their demand for cash by honoring cheques. It opens new accounts, remit funds, issues bank drafts and pay orders etc. Since bank is confined to provide the services everyday, general banking is also known as „retail banking‟.

ACCOUNT OPENING SECTION:

To establish a banker and customer relationship account opening is the first step. Opening of an account binds the Banker and customer into contractual relationship. But selection of customer for opening an account is very crucial for a Bank. Indeed, fraud and forgery of all kinds start by opening account. So, the Bank takes extremely cautious measure in its selection of customers.

The following works are done by this section-

1. Accepting of deposit

2. Opening of account

3. Check book issue

4. Closing of account

ACCCEPTING OF DEPOSIT:

Accepting deposits is one of the main classic functions of banks. The relationship between a banker and his customer begins with the opening of an account by the former in the name of the latter. Initially all the accounts are opened with a deposit of money by the customer and hence these accounts are called deposits accounts. Banker solicits deposits from the members of the public belonging to different lifestyles, engaged in numerous economic activities and having different financial status. There is two officers performing various functions in this department.

The deposits those are accepted by SEBL may be classified in to:

a) Demand Deposits

b) Time Deposits.

DEMAND DEPODITS:

The amount in accounts are payable on demand so it is called demand deposit account. SEBL accepts demand deposits through the opening of –

i. Al-Wadiah Current account(CD)

ii. Mudaraba Savings account(SB)

AL- WADIAH CURRENT ACCOUNT:

Both individuals and business open this type of account. Frequent transactions are (deposits as well as withdrawal) allowed in this type of account. A current a/c holder can draw cheques on his account, any amount, and any numbers of times in a day as the balance in his account permits Criteria of current account followed by SEBL:

- Generally opened by businessmen, government and semi-government organizations; with proper introduction.

- No interest/munafah is provided for deposited amount.

- Overdraft is allowed in this account.

- Minimum opening balance is TK.2000.

- A minimum balance of Tk. 5000/- has to be maintained.

MUDARABA SAVING ACCOUNT:

Individuals for savings purposes open this type of account. Current interest/munafah rate of these accounts is 06% per annum. Interest/ munafah on SB account is calculated and accrued monthly and Credited to the account half yearly. This calculation is made for each month based on the lowest balance at credit of an account in that month. A depositor can withdraw from his SB account not more than twice a week up to an amount not exceeding 25% of the balance in the account. If anyone withdraws money more than twice he/she will not get the interest for that

month.

Criteria of savings account followed by SEBL:

- An appropriate introduction is required for opening the A/C;

- Frequent withdrawal is not encouraged;

- A depositor may withdraw money from his/her account twice in a week;

- Minimum amount of TK.5000 is required as initial deposit;

- Depositor may withdraw his/her deposited money up to 25% of the Balance in his/her account without notice.

- The bank may realize service charge in its discretion.

- Depositor will get interest/munafah on the amount deposited in his/her account.

TIME DEPOSITS:

A deposit which is payable at a fixed date or after a period of notice is a time deposit. In SEBL Motijheel Branch (Islamic Banking) accepts time deposits through Mudaraba Term Deposit Receipt (MTDR), Mudaraba Short Noticed Deposit (MSND), and Mudaraba Schemes etc. While accepting these deposits, a contract is done between the bank and the customer. When the banker opens an account in the name of a customer, there arises a contract between the two. This contract will be a valid one only when both the parties are competent to enter into contracts.

SEBL accepts time deposits through the opening of –

i. Mudaraba Term Deposit Recipt(MTDR)

ii. Mudaraba Short Notice Deposit(MSND)

iii. Mudaraba Monthly Saving Scheme(MMSS)

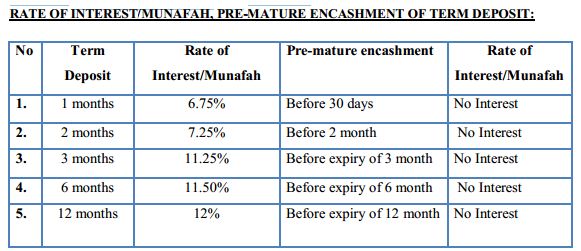

MUDARABA TERM DEPOSIT RECIPT (MTDR)

MTDR are opened for a fixed period varying from one months to three years or above and are payable at a fixed date of maturity. In case of MTDR Account the banks do not have to maintain a cash reserve. So SEBL offers a high interest rate in MTDR accounts. It is usually paid on maturity of the fixed deposit. SEBL calculates interest at each maturity date and provision is made on that “Miscellaneous creditor expenditure payable accounts” is debited for the accrued interest.

From above circumstances it is clear that. If any one runs his/her Deposit up to 11 month and withdraw his/her money in case of any kinds of emergency he/she will not get any types of interest but if The person give an application to Manager than manager can arrange interest of savings rate for that person.

OPENING AN ACCOUNT:

It is said that, there is no banker customer relationship if there is no a/c of a person in that bank. By opening an a/c banker and customer create a contractual relationship. However, selection of customer for opening an account is very crucial for a Bank.

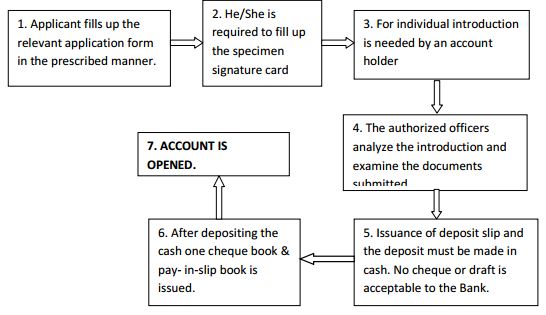

Account opening procedure in flow chart:

(1)For opening an account, at first the prospective account holder will apply for opening an account by filling up account opening form. Account opening form consists of the name of the branch, type of account, name of the applicant(s), present address, permanent address, passport number (if any), date of birth, nationality, occupation, nominee(s), special instruction (if any), initial deposit, specimen signature(s) of the applicant(s), introducer‟s information etc. Moreover have to fill up of KYC form: This form has been introduced by the Bangladesh Bank to prevent money laundering. KYC form helps to asses the customer. Clear instructions with regard to operations are found in KYC. If the transaction of a customer is suspicious or not matched with the KYC than Bank branch should report it to Bangladesh Bank.

1. Applicant fills up the relevant application form in the prescribed manner.

2. He/She is required to fill up the specimen signature card

3. For individual introduction is needed by an account holder

4. The authorized officers analyze the introduction and examine the documents submitted.

5. Issuance of deposit slip and the deposit must be made in cash. No cheque or draft is acceptable to the Bank.

6. After depositing the cash one cheque book & pay- in-slip book is issued.

ACCOUNT IS OPENED

(2) Signature of the prospective account holder in the account opening form and on the specimen signature card duly attested by the introducer. Moreover two copies of passport size photograph duly attested by the introducer.

(3)The prospective customer should be properly introduced by the followings:

i. An existing customer of the bank.

ii. Officials of the bank not below the rank of Assistant Officer.

iii. A respectable person of the locality who is well known to the Manager or authorized officer.

(4) The authorized officers analyze the introduction and examine the documents have submitted. Then the concerned authority will allocate a number for the new account.

(5)The customer than deposit the “initial deposit” by filling up a deposit slips. Initial deposit to open a current account in SBL is Tk. 1000.00 and saving account is Tk. 500.00.

(6)After depositing the cash one cheque book & pay- in-slip book is issued.

(7)Then the account is considered to be opened.

SBL, Motijheel Branch maintains all of its accounts in computer. After depositing the initial deposit, Branch records it in the computer by giving new account number. Then it issues cheque book requisition slip by the customer. Then it distributes all relevant papers to respective department.

ISSUING CHEQUE BOOK TO THE CUSTOMERS:

Fresh cheque book is issued to the account holder only against requisition on the prescribed requisition slip attached with the cheque book issued earlier, after proper verification of the signature of the account holder personally or to his duly authorized representative against proper acknowledgment.

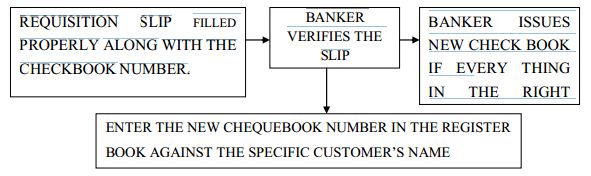

Procedure of issuance of a cheque book in flowchart

Procedure of issuance of a cheque book:

- A customer who opened a new a/c initially deposits minimum required money in the account.

- The account opening form is sent for issuance of a cheque book

- Respected Officer first draws a cheque book

- Officer then sealed it with branch name.

- In-charge officer enters the number of the cheque Book in Cheque Issue Register.

- Officer also entry the customer‟s name and the account number in the same Register.

- Account number is then writing down on the face of the Cheque Book and on every leaf of the Cheque book including Requisition Slip.

- The name of the customer is also written down on the face of the Cheque book and on the Requisition slip.

- The word “Issued on” along with the date of issuance is written down on the requisition slip.

- Number of Cheque book and date of issuance is also written on the application form.

- Next, the customer is asked to sign in the Cheque book issue register.

- Then the respected Officer signs on the face of the requisition slip put his initial in the register and hand over the cheque book to the customer.

MONEY TRANSACTION:

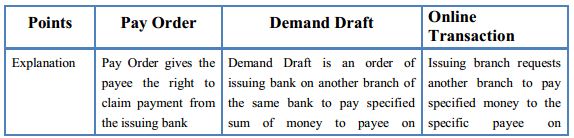

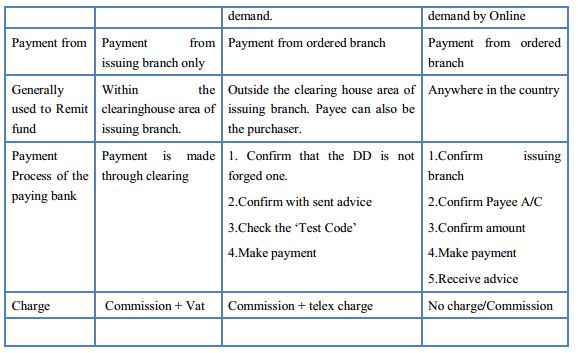

Sending/Transfer money from one place to another place for the customer is another important service of banks. And this service is an important part of country‟s payment system. For this service, people, especially businessmen can transfer funds from one place to another place very quickly.

- Demand Draft

- Pay Order

- Online Transaction

The bank followed modern online transaction (payment & withdrawal of fund) through highspeed WAN service. It is remarkable that customers are often taking advantage of the online transaction. The charges of online transaction are tabled below. It should be mentioned that, there is no commission and fee charged in online transaction inside the clearinghouse. In case of outside the clearinghouse, commission is tk.0.10 and 15% VAT on the commission. The

minimum charge is tk.0.10 commission and VAT on it.

Modes of money transfer:

ACCOUNTS DEPERTMENT

Accounts Department is called as the nerve Centre of the bank. In banking business, transactions are done every day and these transactions are to be recorded properly and systematically as the banks deal with the depositors‟ money. Any deviation in proper recording may hamper public confidence and the bank has to suffer a lot otherwise. Improper recording of transactions will lead to the mismatch in the debit side and in the credit side. To avoid these mishaps, the bank provides a separate department; whose function is to check the mistakes in passing vouchers or

wrong entries or fraud or forgery. This department is called as Accounts Department. Besides the above, the bank has to prepare some internal statements as well as some statutory statements which to be submitted to the central bank. Accounts Department prepares these statements also. The department has to submit some statements to the Head office, which is also consolidated by the Head Office later on. The tasks of the department may be seen in two different angles:

DAILY TASK:

The routine daily tasks of the Accounts Department are as follows, –

- Recording the transactions in the cashbook.

- Recording the transactions in general and subsidiary ledger.

- Preparing the daily position of the branch comprising of deposit and cash.

- Preparing the daily Statement of Affairs showing all the assets and liability of the branch as per General Ledger and Subsidiary Ledger separately.

- Making payment of all the expenses of the branch.

- Recording inter branch fund transfer and providing accounting treatment in this regard.

- Checking whether all the vouchers are correctly passed to ensure the conformity with the „Activity Report‟; if otherwise making it correct by calling the respective official to rectify the voucher.

- Recording of the vouchers in the Voucher Register.

- Packing of the correct vouchers according to the debit voucher and the credit voucher.

PERIODIC TASK:

- Preparing the monthly salary statements for the employees.

- Publishing the basic data of the branch.

- Preparing the weekly position for the branch which is sent to the Head Office to maintain Cash Reserve Requirement (C.R.R)

- Preparing the monthly position for the branch which is sent to the Head Office to maintain Statutory Liquidity Requirement (S.L.R)

- Preparing the weekly position for the branch comprising of the break up of sector wise deposit, credit etc.

- Preparing the weekly position for the branch comprising of denomination wise statement of cash in tills.

- Preparing the budget for the branch by fixing the target regarding profit and deposit so as to take necessary steps to generate and mobilize deposit.

- Preparing an „Extract‟ which is a summary of all the transactions of the Head Office account with the branch to reconcile all the transactions held among the accounts of all the branches.

CASH SECTION

Cash department is the most vital and sensitive organ of the branch as it deals with all kinds of cash transactions. This department starts the day with cash in vault. Each day some cash that is opening cash balance are transferred to the cash officers from the cash vault. Net figure of this cash receipts and payments are added to the opening cash balance. The figure is called closing balance. This closing balance is then added to the vault. And this is the final cash balance figure for the bank at the end of any particular day. Cash department in the Southeast Bank, Motijheel

Branch is authorized dealer of foreign currency, so it can deal with buying and selling of foreign currency.

CRITICAL OBSERVATION & FINDINGS OF PROBLEM

SEBL is one of the potential banks in the banking sector. The Motijheel branch of SEBL is a small branch. It was a wonderful experience working at Southeast Bank Limited. The employees of the bank were very helpful and nice to me. In spite it was not an easy job to find so many things during the very short period of practical orientation program. Now, I would like to present my observations and give, my opinion to improve the banking service and make their customer more satisfied.

i. Lack of dynamic and prompt customer service: Since a number of new banks are coming to existence with their extended customer service pattern in a completely competitive manner. Customer services must be made dynamic and prompt. Now a day, people have very little time to waste but want fastest and unique services in short time. Moreover they seek the bank which will provide more facilities and attractive offer compare to other bank. Therefore southeast bank should think sincerely about the renovation of their customer service and facilities which will be more attractive and innovative rather than traditional one.

ii.Lack of Proper Division of Labor and man power: There is lack of division of labor in the branch. Therefore everybody has to handle every type of banking services. Moreover if one personnel is absence in a department then extra burden will fall to another. This decreases the level of performance of the personnel, though it reduces monotonousness. But lack of division of labor hampers the discipline of working environment. So customers have to wait for some time for the desired service, which is contrary to the Premium Banking objective.

iii.Lack of Proper compilations &Maintenance of Files: Southeast Bank Ltd, Motijheel Branch gives personalized services. All the officers have to give concentration to the customers, while doing this they cannot properly completed and maintain the customer files. In many cases, most of the files and papers are kept here and there by the officers during the busy hour.

iv. Shortage of availability of Machineries: Motijheel Branch is supposed to be very well equipped by advance and available machineries. But there are shortages of photocopy and printing machine therefore most of the time employees activities are hampered for maintaining serial as well as it create gathering on their short space. This loses its glamour. Moreover as because of lacking of maintenance and over used when one machine of any department stops working then the load shift to another department badly.

v. Employee Dissatisfaction: Because of late promotion and longer probationary period there is dissatisfaction among the employees. More over some sort of internal politics also another reason behind proper recognition and promotion of employees. In addition most of the time over duties and huge working pressure makes their life monotonous and hamper their family life.

vi. Confusion on double standard banking: Beside the general banking system, Islamic banking system has been introduced in Southeast Bank Limited. This sort of double standard in banking may create confusion in the mind of customers. The most important think which I have observed is that SEBL, Motijheel Branch is an Islamic Banking Branch but the branch is following corporate banking method. So I think bank should follow the rules of Islamic Banking otherwise this kind of collapse can hamper the reputation of the bank.

vii. Lack of effective advertising and promotion: Advertising and promotion is one of the weak point of Southeast Bank Limited, Southeast Bank Limited does not have any effective promotional activities through advertisement, but other banks have better promotional strategy. Therefore most customers are not known about their Islamic banking branch.

viii. Lack of Computer Knowledge: All the organizations including banks are now mostly depends on computer but employees do not have much knowledge on computer.

ix. Absence of proper Decoration and congested office area: Decoration of the SEBL has become old. So, young people are not attracted to this branch as well as employees are not getting the congenial environment. Customers are also facing the problem with as because of its congested office area. Most of the time at busy hour customer rarely get any seat which hamper their service as well as such gathering also hamper office environment.

x. Unsatisfactory software performance: Southeast bank use Ultimus software for performing their banking activities. But the software often hanged as because of slower upgrade of data by vender. Therefore it delays to performing banking activities at time.

xi. No desk and specific task for internee: Southeast bank doesn‟t arrange any desk and fixed any task for their internee. Therefore they don‟t get any chance to learn banking activities by doing practical task. It is not possible for any fresh graduate to learn banking activities by getting few lecture from specific personnel rather if they involve them to some specific activities it would be easy for them to learn more and fell confident to perform any activities properly. Moreover as they do not pay any allowance to internee so some time it does not motivated them to present and learn eagerly.

RECOMMENDATION

i. Renovation of customer service: Southeast bank should make its service prompt so that people need not give more time in the banking activities and fell easy to perform all respective activities. Moreover they have to come up with new facilities and offer which will attract more client and help to ensure their premium as

well as loyal customer forever. Therefore they have to ensure-

- The working process more faster with better computers and operating systems

- Trained, experienced, smart, knowledgeable as well as intellectual personnel to provide fastest and the best services.

- Individual attention can be given to customers in order to better understand the customer‟s needs and better satisfy them.

( Cheques, deposit slips are not written properly by the customers so the employees have to do that) - More ATM booth in merchant location

- More Gifts, Discounts as well as differentiated interest rates on several loan and deposit schemes for the Premium Customers

- Car parking facility

ii. Ensure Proper Division of Labor and man power: The human resource departments of southeast bank have to ensure proper division of labor in desk for handling the rash of customer in an efficient way. Therefore based on importance and work load they have to ensure proper division of labor. Moreover by increasing the numbers of personnel try to maintain the premium banking objective. Mainly the number of human resources is needed in Front Desk and in clearing section which really insufficient for giving services to huge number of customers.

iii. Ensure Proper compilations &Maintenance of Files: Ensuring proper customer service is a continuous process in banking business. Which is vital for it success. The service starts from the first day of customer interaction with banker. To know customer, maintain interaction, conducting banking activities and for the security purposes the file maintenance of individual client is most important. If one single paper is missing then it can create a big problem as well as hazard to both banker and their customer. Therefore both branch management and all personnel

should more conscious about the proper compilations as well as decoration for keeping important files.

iv. Ensure availability of Machineries: Every department should ensure the availability and proper maintenance of necessary machines like photocopy and printing machines.

v. Ensure employee satisfaction: Management of the bank has to provide time to time recognition of their employee. Moreover short probationary period and on time promotion motivated the employee to perform well in their day to day activities. But the most important thing is the overall motivational activities should be proceeding under fair judgment based on performance rather internal politics. In addition through assurance of proper division of labor, incentive for over duty and mandatory leave help to overcome huge working load and enjoy a sound as well as healthy life. Besides good relationship amongst employee and sound working environment also help the employee to be satisfied with their job.

vi. Ensure proper rules and regulation of Islamic banking: The Islamic branch should follow Islamic banking appropriately. Southeast Bank has 38 branches but only 5 branches is Islamic banking branch including Motijheel branch. I have observed something very closely that the branch is not following Islamic rules and regulation in this branch. Interest rate, profit and loss amount all things are same as corporate branches. So my recommendation is to follow the rules of Islamic Banking otherwise the banks reputation can be hampered.

vii. Ensure proper promotional activities: They must prepare an organized set of plan regarding the advertising and promotional activities which should include billboards, internet advertising and sponsorship. The sales team and officers should provide periodic training on interacting and dealing with different classes of potential and existing customers.

viii. Ensure effective computer literacy: As the bank is now mostly depends on computer therefore to increase the computer skills of employees, the bank should provide training. Though they have knowledge about computer but it is not enough. So bank should provide training to their employees to make them efficient in computer.

ix. Ensure of proper Decoration and expanded office area: Motijheel branch authorization should have to be more conscious and innovative in their interior decoration to attract client from all ages. As motijheel area is the business area so the rush of client is the common scenario of this branch so the space should be extended for conducting and performing sound banking activities, service as well.

x. Should use fastest software: SEBL,MB should uses more first and modernize software for internal transaction or entry the information to compete with foreign bank. So I think the new software can help to perform internal work more easily and swiftly.

xi. Ensure internship desk and specific task: This branch is renowned for the internship. So bank should provide the internship desk and some specific task for gathering some real life experience which they can utilize in their future job. Moreover small amount of remuneration should provide to internee for realize their importance as well as motivate to perform the task properly.

CONCLUSION

During the three months of internship program at Southeast Bank Motijheel Branch almost all the desk have been observed more or less other than Foreign Exchange Department. This practical orientation program, in first has been arranged for gaining knowledge of practical banking and to compare this practical with theoretical knowledge. Comparing practical knowledge with theoretical involves identification of weakness in the branch activities and

making recommendations for solving the weakness identified. Through all departments and sections are tried to cover in which I got the chance to gather practical experience for the internship program; it is not possible to go to the depth of each activities of branch because of time limitation. However, highest effort has been given to achieve the objectives the internship program.