From the beginning of the civilization the banking sector dominates the economic development of a country by mobilizing the saving from the general people and channeling those saving for investment and thus economic development and growth. To satisfy the demand as well as to improve the commercial banking service in our country, HSBC Bank, a scheduled bank, was incorporated to initiate its operation with the aim to play the vital role on the socio-economic development of the country. With the world knowing identity, Hong Kong and Shanghai Banking Corporation (HSBC) started its operation in Bangladesh in 1996. With such a brand image, outstanding Trade supporting activities and modern product and service area, they also built a place in Bangladeshi market as well. So here I have tried to focus upon the newly introduced online LC posting system of HSBC in Bangladesh, highlighting in Dhaka city.

Starting from the company overview, I have put light on giving a brief about HSBC as a global bank and HSBC in Bangladesh. Additional, I have moved on to the products and services they are providing. Furthermore I added the jobs I have performed during my internship period. During my internship I had some observation so I also included them into my report along with recommendation.

The study also reflects the summary of the project on which I worked. The objective of the project, methodology and limitations is also included in this part. I have also included different parts of my project. Finally I analyzed the project in my own word. Analysis on the findings in basically done to sort out the major aspects of the Project. At the same time for easier understanding of the report, supporting topics and terms are explained in the light of textbooks and regulatory guidelines. Utmost care has been given to explain all necessary aspects related to the subject matter for easier and quick understanding of the report.

Introduction

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word „Bank‟ was probably derived from the word „Bench‟ as during ancient time Jews used to do money lending business sitting on long benched.

First modern banking was introduced in 1668 in Stockholm as „Savings Pis Bank‟, which opened up a new era of banking, activates throughout the European Mainland. In the North Asia region, the Afghan traders popularly known as Kabliwallas introduced early banking system. Muslim businessmen from Kabul, Afghanistan came to India & started money lending business in exchange of interest sometime in 1312 A.D. they were known s „Kabuliwallas‟.

Banks are now beyond those old concepts. Now bank represents a significant & influential sector of business worldwide. Most individuals and originations make use of the Banks, either as depositors and borrowers. Bank play a major role in maintaining confidence in the monetary system through their close relationship with regulatory authorities & governments the regulation imposed on them by those government.

One of the most important factors for industrialization and economic development of a country is the situation of their trade. Trade is one of the major sources of earning. But it is not completely possible to go for global trade without the help of financial organization. HSBC is providing such kind of tremendous service. GTRF (Global Trade and Receivable Finance) is the department of HSBC bank that mainly provides financial support to the needed people to gratify their financial need. So, I think, my study on automation of LC system is extremely justified in the light of how HSBCs automated LC systems works.

Objective

The objective of this report is associated with the internship purpose. The internship objective is to acquire practical facts and experiencing the corporate working environment. To this Concern this report is contemplating the knowledge and experience accumulated from internship program. With the set rules and suggestion by the BRAC University and with the generous assistances of the organization and the internship supervisor, this report mainly comprise of an organization part and a project part.

The prime objective if organization part is:

- To demonstrate a brief summary of HongKong and Shanghai Banking Corporation Ltd.

The major objectives of project part are:

- Give a very short summary of Bangladesh Banks introduced automated LC system and discuss some of the very simple rules and regulations imposed by Bangladesh Bank for posting this automated LC.

- Provide recommendation the remedial majors for the improvement of Import L/C services by HSBC.

Significance of the report:

Other than determining the automation process of L/C system, it will also be useful to employees, competitors, interns and industry as a whole. Employees can find out the process of the system and how well they are dealing with it. Interns can easily understand what the process of working is and how to cope up with the system. Competitors can also benefit from the outcomes of this study by getting an indication of where to focus its resources. Finally this will help the whole organization to find out the problems of this system also they will get some solution which will help them to deal with the problems.

Overview of HSBC

The HSBC Group is named after its founding member, The Hongkong and Shanghai Banking Corporation Limited, which was established in 1865 in Hong Kong and Shanghai to finance the growing trade between China and Europe. Thomas Sutherland, a Hong Kong Superintendent of the Peninsular and Oriental Steam Navigation Company helped to establish this bank in March 1865. Throughout the late nineteenth and the early twentieth centuries, the bank established a network of agencies and branches based mainly in China and South East Asia but also with representation in the Indian sub-continent, Japan, Europe and North America. The post-war political and economic changes in the world forced the bank to analyze its strategy for continued growth in the 1950s. The bank diversified both its business and its geographical spread through acquisitions and alliances.

HSBC Holdings plc, the parent company of the HSBC Group, was established in 1991 with its shares quoted on both the London and Hong Kong stock exchanges. The HSBC Group now comprises a unique range of banks and financial service providers around the globe. HSBC maintains one of the world‟s largest private data communication networks and is reconfiguring its business for the e-age. Its rapidly growing e-commerce capability includes the use of the internet, PC banking over a private network, interactive TV, and fixed and mobile, including wireless application protocol or WAPenabled mobile, telephones.

HSBC is the world’s local bank headquartered in London, HSBC is one of the largest banking and financial services organizations in the world. It is the world’s largest company and the world’s largest banking group, as calculated based on different metrics by the annual Forbes list of the world’s largest firms published on April 2, 2008. In February 2008, HSBC was named the world’s most valuable banking brand by The Banker magazine. HSBC’s international network comprises over 7200 offices in 80 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. HSBC has 55 million customers worldwide with listings on the London, Hong Kong, New York, Paris and Bermuda stock exchanges, shares in HSBC Holdings plc are held by around 210,000 shareholders in some 80 countries and territories.

Through an international network linked by advanced technology, including a rapidly growing eCommerce capability, HSBC globally provides a comprehensive range of financial services, personal financial services, commercial banking, corporate, investment banking and markets and other activities. The establishment in 1999 of HSBC as a uniform, international brand name ensured that the Group‟s corporate symbol has become an increasingly familiar sight across the world. HSBC differentiates its brand from those of its competitors by describing the unique characteristics that distinguish HSBC, summarized by the words “The World‟s local bank”.

HSBC‟s commitment to service excellence, reputation for stability and understanding of the region has repeatedly been recognized through citations by major business publications. HSBC Holdings was established in 1991 to become the parent company to The Hongkong and Shanghai Banking Corporation Limited. HSBC is well-known in banking circles for its diversified and risk-averse approach in its business operations.

According to Forbes magazine, the world’s largest bank (based on a composite score) is currently the fourth largest bank in the world in terms of assets ($2.693 trillion), the second largest in terms of sales and reported profit before tax up 30% in the third quarter of 2013 at US$4,530 million, the largest in terms of market value ($180.81 billion), and the most profitable bank in the world with $18.6 billion in net income for the first nine months of 2013. The HSBC Group has an international pedigree, which is unique. Many of its principal companies opened for business over a century ago and they have a history rich in variety and achievement.

Products and Service

HSBC is one of the leading multinational banks. It has gained its popularity by providing excellent services. It has a variety range of services which includes retail banking, trade and much more. The range of services offered by HSBC in Bangladesh is:

a) Personal Financial Services

The Bank has a variety of products and services intended to satisfy individual requirements. The variety of products & services for distinct customers comprises of the following:

- Online Banking

- ATM

- Phone banking

- Customer Service Centre (CSC)

- Savings

- Current

- Time Deposit Accounts

- Personal Savings Plans – Personal Lending Products

- Foreign currency banking services both for Resident and Non-resident Bangladeshis.

Moreover HSBC is devoted to deliver a superior level of custom-made service, which is being regularly supervised.

b) Savings Account

This account helps to maximize wealth with daily interest. Besides customers can issue any number of cheques or withdraw any amount. Here interest is calculated on daily credit balance and paid half yearly. However there is a condition to earn interest which includes that the customers have to maintain a minimum balance of BDT 25,000. Furthermore there are other fees in this account for example; Relationship fee- BDT 300/ per quarter.

c) Current Account

This is also a collection account basically intended for various customers. This is an non-interest bearing account. The Opening balance in this account has to be TK 25,000. Here average balance needs to be maintained TK 25,000. There are no restrictions on number of transactions. It does not include any yearly ledger fee, this account is non-interest bearing but it provides free ATM card and phone banking service. This account can be opened only by Individuals which can be joint or single, proprietorship companies, partnership companies, limited companies, liaison offices, NGO‟s. The main problem of this account is that various kinds of documents are needed for the companies such as memorandum of association, board resolution, etc. Other than that the requirements for individuals are same as the savings account.

d) ATM Card

Now a days ATM card is very popular and it has made everyone‟s life easier. This card can be connected with Savings or Current Account or both. It can be used 24 Hours a day from any one of the HSBC ATM outlets. However, the Maximum limit BDT 20,000/- per day per card. But for PVA maximum limit is BDT 50,000/ per day. Moreover it provides the opportunity of withdrawing or depositing money, inquiring about balance, checking last 5 transactions, transferring funds and making payments to other accounts with HSBC. The Minimum BDT 500/- can be withdrawn from with this card.

e) Power Vantage

For total financial control the average deposit balance should be BDT 2, 00,000/ besides annual fee BDT 500/, penalty charge BDT 500/ half yearly if the average deposit balance falls below BDT 2,00,000/. But it provides free personal accident insurance coverage for BDT 1, 00,000/, free endorsement of foreign currency against travel quota, special Power Vantage ATM card with enhanced cash withdrawal facility of BDT 50,000/ per day, special loan rage for the Personal Installment Loan, lower processing fee for Car Loan.

f) Time Deposit

Minimum amount of opening this account is BDT 1,00,000/ both Individual and Joint. For this account interest is paid at maturity. Cumulative Time Deposits (Principal + Interest) is also available for this account. Personal Secured Loan which means a loan facility up to 90% of the value of the local currency and 80% of foreign currency time deposit for a maximum period of 5 years. For this account personal Secured Credit , an overdraft facility up to 90% of the value LCY and 80% of the FCY time deposit.

g) Short Term Deposit (STD)

Organizations mostly open this account. Organizations normally maintain current accounts in the banks. They need to manage majority amount regularly that‟s why, current account fits with their requirements. The current accounts do not provide any interests. The organizations cannot have savings account. Because of this reason they are deprived of earning any interest. Though they have huge savings they do not get the opportunity of earning interest. Thus short term deposit accounts enable them to earn interests from their accounts. This account has some features of both saving account and current account. For example it provides interests which are like the savings accounts and the holder can withdraw any amount any time from his account which is a property of the current account. Mostly businessman maintains this kind of account.

Import Letter of Credit Project & Analysis

Summary

Banking is one of the most challenging industries of Bangladesh. It has shown massive development during the last period. Some of the new banks have entered this industry so it has made the industry more competitive. So in such kind of competitive industry it is really important to maintain customer satisfaction and good service. Companies which provide excellent service are able to compete. HSBC is one of them.

The project for which I worked was related to GTRF department. At first they were used to do all the L/C related information‟s manually. However afterward Bangladesh Bank introduced new digital system to provide all the information‟s digitally on their website. Because of that they took this project in hand which included posting all the information on Bangladesh Bank website and for this reason they started hiring interns.

Project

The project mainly started as Bangladesh bank introduced new online based L/C system. Bangladesh Bank is the central bank. As the central bank the financial system of Bangladesh consists of Bangladesh Bank (BB). As the central bank Bangladesh Bank supervises and regulates all the bank and non-bank financial institution as they have the legal authority. Being the banker to the government and banks it performs the traditional central banking roles. It formulates as well as implements monetary policy manages foreign exchange reserves and lays down sensible regulations and conduct monitoring thereof by giving some broad policy rules and they apply to the entire banking system. Its sensible regulations include, among others: minimum capital requirements, limits on loan concentration and insider borrowing and guidelines for asset classification and income recognition. The Bangladesh Bank has the control to impose consequences for non-compliance and also to intervene in the management of a bank if serious problem arise. It also has the delegated authority of issuing policy directives regarding the foreign exchange regime. As they have the right to monitor all the trade transection the banks made they decided to convert in to manually. In this way the lessened their hassle of looking and analyzing L/C related information manually. On a test basis they started this online based L/C system on the middle of last year, 2012. The banks were on a practice during that year. They learnt the procedure and the rules and regulation of this online posting system. Finally on 1st January 2013 they officially made it mandatory for all the banks to give all the L/C related information digitally instead of manually.

Besides, they introduce an electronic system 12th February, 2013 for monitoring all kind of transactions involving foreign exchange in the country‟s banking system to tackle misappropriation. They introduced electronic screen known as dashboard. BB monitors through the dashboard the procedure of letters of credit for imports and exports by banks, inward and outward remittance processes and all other foreign exchange related transactions. After the introduction of the dashboard the BB officials are now able to supervise bank-wise outstanding domestic documentary bills and the amount of bills of acceptance to be given by a branch of a bank in a day. Moreover, scheduled banks will also be able to administer their own operation as a bank as they would be able to monitor the business situation at its branches through the BB web portal.

Bangladesh Bank also imposed some rules regarding the online L/C posting for other banks. To comply with the Bangladesh Banks newly introduced online system HSBC had to introduce the project. And I was a part of it. As a part of the project I have worked in GTRF department. In GTRF department I have worked on returns section where they mainly deal with L/C opening, IMP posting and Bill of entry. The project in which I was involved was mainly about dealing with overdue of bill of entry. Now at first let‟s have a glance at GTRF department:

Global Trade & Receivable Finance (GTRF)

In 1865 HSBC initiated trade and financed commerce between Europe, North America and Asia. As a part of commercial banking, GTRF is a universal product line. Nowadays, with 10% market share in terms of revenue, GTRF is leading international trade bank. (Source: OW Global Transaction Banking Survey 2012). In 2012 GTRF global revenue totaled USD3.5bn. GTRF mainly supports to meet two fundamental requirements for buyers and suppliers:

1. Supporting cash flow: In this section GTRF supports cash flow which means, financing raw materials and the manufacturing process, discounting receivables and collecting payments for goods sold.

2. Providing risk management: In this part GTRF aids by giving protection for suppliers‟ performance and buyer payment, risk which helps enable trading relationships. Both of these parts are very important for buyer and supplier in trade. HSBC is the leading trade bank as it has preasence in 7 of the export processing zones (EPZ).

These 7 EPZs are in Dhaka, Chittagong, Comilla, Mongla, Adamjee, Karnaphuli and Ishwardi. It controls on vast global network and wide range of trade products and services to accomplish customers‟ business needs. The product ranges from traditional trade financing methods to advanced organized solutions. Besides it provides global trade finance as well as finance solutions; letter of credit, collections, guarantees; receivables finance; supply chain solutions; commodity and structured financed; and risk distribution. The global revenue of GTRF totaled USD3.5 billion in 2012.

Moreover in every minute GRF processes USD 1 million of trade turnover. They have over 4500 people helping customers trade across more than 60 countries. HSBC facilitated more thanUSD500 billions of trade in 2012.

GTRF Product

This department mainly provides the services and financing the clients need throughout the trade cycle. From the tender process and insurance of a payment order, through to shipment and sales fulfillment they provide financing. They cover various industries which includes commodities, global sourcing, technology and infrastructure.

Moreover they provide international trade finance as well as financial solutions, letter of credit , collections, guarantees, receivables finance, supply chain solutions, commodity structured finance and risk distribution.

The Letter of credit mainly deals with import export. So when expert or import will increase the demand of L/C will also increase. In January-May 2013 export rose by 7.2% which was 6.2% last year and in future I expect it will grow on. So the demand for L/C will also go up. The project where I worked I mainly posted the information about the import related L/C‟s. So now let‟s get to some information regarding L/C:

Letter of Credit (L/C)

Letters of credit (L/C) is one of the most multipurpose and safe instruments available to international traders. “An L/C is a assurance by a bank on behalf of the importer (foreign buyer) that payment will be made to the beneficiary (exporter) provided that the terms and conditions stated in the L/C have been met, as evidenced by the presentation of specified documents”. The importer pays a fee to get this kind of service. An L/C is beneficial when reliable credit information about a foreign buyer is difficult to get or if the foreign buyer‟s credit is not acceptable, but the exporter is satisfied with the creditworthiness of the importer‟s bank. This method also protects the importer since the documents required to trigger payment provide evidence that goods have been shipped as agreed. However, because L/Cs has opportunities for inconsistencies, which may refute payment to the exporter, documents should be prepared by trained professionals or outsourced. Discrepant documents, literally not having an “i dotted and t crossed,” may negate the bank‟s payment obligation.

Characteristics

Validity

It is recommended for use L/C in higher-risk situations or new or less-established trade relationships when the exporter is satisfied with the creditworthiness of the buyer‟s bank.

Risk

Risk is spread between exporter and importer. The importer and exporter has to obey all the rules, terms and conditions provided.

Other Characteristics

- Payment is made after shipment.

- A variety of payment, financing and risk justification options are available.

- It is relatively expensive method in terms of transaction costs.

- It is an arrangement by banks for settling international commercial transactions.

- It provides a form of security for the parties’ involved.

- It ensures payment if the terms and conditions of the credit have been fulfilled.

- It may not be changed or cancelled unless the importer, banks, and exporter agree

Types of L/C

a) Sight Letter of Credit

It is such kind of letter of credit that is payable once it is presented along with the necessary documents. The organization that offers a sight L/C binds itself to paying the agreed amount of funds provided the provisions of the letter of credit are met. For instance, a business person may present a bill of exchange to a lender along with a sight letter of credit, and collect the necessary funds right then. A sight letter of credit is thus more “on demand” than some other types of letters of credit. The time limit of paying is mostly 5 days.

b) Acceptance Letter of Credit

In acceptance letter of credit there is a time frame. It is paid after a specific date, if the terms of the letter of credit have been complied with. There are two types of acceptance credit. One is confirmed and another one is unconfirmed. Unconfirmed acceptance credit means that the seller takes the risk that payment will not be made, due to any number of contingencies such as shipment non delivery or any other problems. Confirmed acceptance credit means that the bank upon which the credit has been issued, essentially guarantees payment as long as the terms of the letter of credit have been complied with. The payment date may be for example 90 days after the invoice date or the date of transport documents. When the documents are presented the draft is accepted instead of payment

being made.

c) Deferred Letter of Credit

A deferred payment letter of credit states to a letter of credit that is paid after a fixed number of days. Generally, it is used by individuals who have a close business relationship, since it allows the buyer of goods a grace period before payment is demanded. During the payment period, the buyer can often sell the goods and pay the credit amount with the proceeds.

d) Letter of Credit with Advance Payment

Some letters of credit provide for advance payment of a portion of the credit prior to compliance with all the credit provisions. The purpose of this advance is to give the exporter, the fluids necessary to purchase or process merchandise especially for the buyer. Two typical arrangements deserve mention.

Special types of L/C

a) Transferable L/C

This type of L/C gives permission to the recipient to transfer his rights in part or in full to another party. Sometimes the seller is not the actual producer or manufacturer of the goods. In this kind of situation the original recipient request for a transferable credit. The issuing bank can do this. This transferable credit can be done once.

b) Back to back L/C

In this case one credit backs another one. Sometimes the seller is unable to supply the goods at that time he purchases the needed goods from another and makes payment by opening a second L/C. In this case the second L/C is called Back to back L/C.

Letter of Credit Process

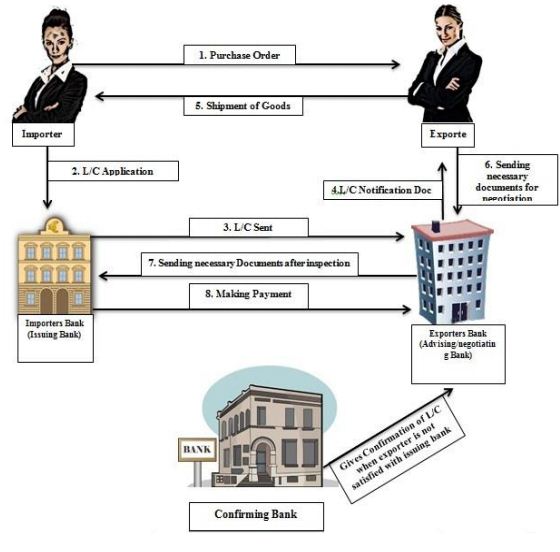

The L/C process mainly comprises of Importer and exporter. Importer is the buyer and the seller is exporter. At first of the L/C process the importer and exporter agrees to terms including means of transport, period of credit offered, and latest date of shipment acceptable. After that the importer applies to bank for issue of letter of credit. The bank of importer is known as issuing bank. The issuing bank will evaluate importer’s credit standing, and may require cash cover or reduction of other lending limits. Afterwards issuing bank issues L/C, sending it to the Advising bank by airmail or electronic means. The exporter‟s bank is known as advising bank or negotiating bank. Advising bank

establishes validity of the letter of credit using signature books then informs exporter. Exporter then checks that L/C matches commercial agreement and that all its terms and conditions can be satisfied. Exporter ships the goods, then assembles the documents called for in the L/C (invoice, transport document, etc.). The Advising bank checks the documents against the L/C. If the documents are compliant, the bank pays the seller and forwards the documents to the Issuing bank.

The Issuing bank later checks the documents itself. If they are in order, it repays the seller’s bank immediately. The Issuing bank debits the buyer and releases the documents (including transport document), so the buyer can claim the goods from the carrier. When the goods are according the L/C doc the doc is called a Clean Doc. If the features of goods are not according to L/C doc it will be called as Discrepant Doc. When there is a clean doc within 5 working days exporter wants his money. If it is discrepant doc then importer will get 21 days for negotiation. If the fault is of exporter then he might demand less money from the importer or importer sometimes sends back the goods.

Now if we point out the steps the steps will be like;

- Step 1: At first the importer has to obtain IRC from the appropriate authority.

- Step 2: Then the importer has to sign purchase contract with the exporter.

- Step 3: Afterwards the importer has to find out an importer bank mainly known as issuing bank and has to request the bank to open an L/C on behalf of the importer favoring the exporter.

- Step 4: Later the issuing bank issues the L/C in agreement with the request of the importer and request another bank, exporter‟s bank known as advising bank located in exporter’s country to advise the L/C to the recipient.

- Step 5: Subsequently the exporter‟s bank (advising bank) informs the exporter that the L/C has been issued.

- Step 6: As soon as the exporter gets the L/C at first he checks if it is satisfying and he can meet L/C terms and conditions, he is in a position to make shipment of the goods.

- Step 7: The exporter submits the necessary documents to the negotiating bank for negotiation after the shipment of goods.

- Step 8: The negotiating bank then inspects the documents and if found the documents are right than they Negotiate documents and sends the said documents to the L/C issuing bank

- Step 9: After receiving the documents the L/C issuing bank also verifies the document and if they find the documents is right they make payment to the negotiating bank.

- Step 10: Finally the L/C opening bank then requests the importer to receive the document payments Bangladesh is doing very good in trade. The growth of trade proves that the demand for L/C is high and will be higher in future. Last year, 8% of Bangladeshi exports went to Asia at the same time as nearly 20% went to North America and more than 40% went to Europe. This is because wages are lower in Bangladesh than in many Chinese regions and South-East Asian countries, and this competitive advantage has enabled low-cost manufacturing industries such as textiles to grow rapidly over the past decade. Bangladesh now has a share of more than 10% of the world market for clothing and apparel. As this is the picture now we hope that it will grow more in future.

Though Bangladesh is performing well in trade they need to focus of some issues more which will help to increase more import export and it will have an effect on L/C. If import or export increases then businessman will need to open more and more L/C. So the demand will go up.Trade is an important part of any bank. The efficiency of this department depends on how well they can manage the Letter of credit system. The letter of credit is very essential part of trade. Without L/C people cannot think of trade. For HSBC trade is an important part. For this reason they try their level best to manage this section efficiently. The analysis part is divided into two section. In the first part I will represent the analysis of their manual and automation system and in the second part I will represent how differently they are doing this work.

Manually versus Automation

Opening of import letter of credit:

The ministry of commerce in accordance with imports and export control act 1950 regulates the import of goods into Bangladesh. Bangladesh bank controls the financial aspects for instance methods of payments, rates of exchange, remittances beside imports through its exchange control department under the provision of foreign exchange regulation Act 1947. The goods are physically supervised by the customs Authorities. After their supervision the goods are permissible under import trade control regulation.

1. Pre-Requisite for opening of a letter of credit

For opening a L/C in HSBC bank the person has to be an account holder or a client of the bank. After that he/she has to submit a request letter to open L/C. Than the person has to have an original Import Registration Certificate which is essential for verification. Besides, the person will also need a membership certificate from a registered Chamber of Commerce and Industries or trade association. Moreover he/she will need a trade license, income tax declaration, proforma invoice issued by the foreign supplier. Finally has to fix up the margin for L/C and it needs to be decided on a mutual basis.

2. Required Documents

i) Documentary Credit Application. This is an agreement between the bank and importer.

ii) Insurance Cover Note. This can be for marine, air or post but it has to be in favor of the bank.

iii) Set of IMP form which will consist of 4 copies. This has to be signed by importer. From four form 3 will be left with the bank and they will fill it after the arrival of documents from the negotiating bank. One will be used for the bill of entry purpose later on.

iv) Undertaking will be signed for the fluctuation of foreign currency.

v) L/C Authorization form which has to be signed by the importer along with the permission from Bangladesh Bank.

3. Analyzing L/C Application

After getting the L/C application from the importer HSBC verifies the signature of importer with the specimen signature available with the bank. Than has to check whether the imported items are according to the proforma invoice and has to check that the goods are not restricted. Also has to check if the L/C obeys the exchange control regulation. Also has to analyze that the transportation insurance is appropriate. After getting all these documents in order HSBC approves the amount of margin on the basis of importers past performance, financial situation, and marketability of goods. After all the analysis HSBC sanctions the margin with careful consideration.

4. Opening of L/C

After analyzing the necessary documents HSBC prepares the L/C signed by two authorized signatories of the bank. They also arrange two copies of reimbursement authority. Then they send two copies of L/C papers along with a forwarding letter to the negotiating bank. Besides, they send a reimbursement authority.

5. Permission from Bangladesh Bank

To import any of the goods Bangladesh banks permission is a must. The letter of credit has to be registered by Bangladesh Bank. They have to get clearance from the exchange control department of Bangladesh Bank. If they import is under external economic aid or credit, commodity scheme or wage earners scheme than the authorization form has to be registered with Bangladesh Bank registration unit.

6. Authorization form of L/C

This authorization forms are available in sets. Each set consists of five copies. This is very essential form. When the import of goods is on loan, barter and aid this form will not be needed. At that time the importers nominated bank will submit the form directly to the designated bank. The designated bank will approve with their sign date along with seal. The bank will keep two copies of which one will be original one. And then they will send two copies to the licensing office. A copy will also be sent to the importers bank. The importer has to sign the L/C authorization forms themselves in all cases in the presence of the Authorized officer of the bank. The Authorized dealer has to sign the L/CAF evidencing verification of the importers sign and his entitlement. In this case authorized dealer has to be satisfied before allowing their client to sign the L/CAF. The banks official concerned also has to put his signature along with date and seal. Authorized Dealers should not under any circumstances, make remittance against any L/CAF after expiry of the registration validity without first finding revalidation of registration from the Bangladesh Bank. They need to ensure that registration number as given by the Bangladesh Bank is correctly and legibly reproduced on the IMP forms.

7. L/C against import

Authorized Dealers, have to establish L/C against specific authorization only on behalf of their own customers who maintain accounts with them. Payments in withdrawal of the bills drawn under L/Cs must be received by the Authorized Dealers by debit to the account of the concerned customer. These restrictions will not only apply to import of articles for the private use of the importer (actual user). All L/Cs and similar undertaking covering imports into Bangladesh must be documentary L/C. and should provide for payment to be made against full sets of on board (shipped) bills of lading, air consignment notes, railway receipts, post parcel receipts showing dispatch of goods covered by the credit to a place in Bangladesh. All L/Cs must specify submission of signed invoices and certificates of origin. If any particular L/CAF requires the submissions of any other document or the remittance of exchange at certain periodical intervals or in any other manner, the L/Cs should be opened incorporating the instruction contained on the L/CAF. It is not permissible to open L/C for imports into Bangladesh in favor of beneficiaries in countries imports from which are banned by the competent authority. L/Cs covering import of goods into Bangladesh against valid L/CAF should be opened within the period prescribed by the Licensing Authority. No amendment or revalidation of L/C against L/CAF will be valid without the prior permission of the Licensing Authority. However, this restriction shall not be applied where the amendment is of technical nature or where the

extension is made up to the period of validity for shipment against relative L/CAF.

8. Advising of Letter of Credit

Advising is forwarding of a Documentary Letter of Credit received from the Issuing Bank to the exporter. Before advising an L/C the Advising Bank have to see the signatures of Issuing Bank officials on the L/C verified with the specimen signatures Book of the said bank when L/C received by airmail. Then they will make an entry in the L/C Advising Register. Finally the L/C will be advised to the exporter promptly and advising charges will be recovered.

9. Amendments to Letter of Credit

After issuance and advising of a Letter of Credit, sometimes the need of changing some of the clauses of the Credit might arise. All these alterations are communicated to the exporter through the same Advising Bank of the Credit. Such modifications to a L/C are termed as amendment to a Letter of Credit. There may be some of the conditions in a Credit are not acceptable by the exporter. In this case, exporter contacts applicant and request for amendment of the clauses. On receipt of such request applicant approaches his banker, issuing bank with a written request for amendment to the Credit. The issuing Bank inspects the proposal for amendment and same are not in contravention with the Exchange Control Regulation and bank’s interest bank may then process for amendments form an integral part of the original Credit. If there is more than one amendment to a Credit, all the amendment have to bear the consecutive serial number that the advising bank can identify the missing of any amendment. The Issuing Bank has to obtain written application from the applicant which will be signed and verified by the bank. If the value increases application for amendment has to be supported by Pro-forma Invoice evidencing consent of the exporter. In case of extension of shipment period, it should be ensured that relative L/CA is valid up to the period of proposed extension. Proper recording and filing of amendment has to be maintained. Amendment charges will be recovered and necessary voucher has to be passed. Some clauses in L/C are amended. For instance; Increase or decrease value of L/C and increase or decrease of quantity of goods, extension of shipment/negotiation period, terms of delivery, mode of shipment, inspection clause, name and address of the supplier, name of reimbursing bank, name of the shipping line etc.

Retirement of Import Bills

Retirement means release of document on receipt of full payment of the bills from customers. This process of settlement of import claims is technically known as retirement of bills. Before retirement bank has to ensure that all payables have been recovered and that all formalities including exchange control requirements are complied with. On receipt of intimation, the importer gives necessary instructions with regard to retirement of bill. The importer might ask the bank to retire the bill by debit to his account. The shipping documents are handed over to the importer after adjustment of the loan to the debit of his account. Before delivering the import documents to the importer, the Bank has to endorse on the invoices the amount that they have remitted from Bangladesh. They also have to endorse the bill of exchange and bill of lading to the order of the importer. Besides, they will need to return the custom purpose copy of the L/CA to the importer for clearance of the consignment from the custom authority. All payments for imports into Bangladesh have to be reported to Bangladesh Bank with the original copy of the IMP form duly certified by the Bank. The importer is required to produce exchange control copy of customs bill of entry to the bank within 4 months from the date of payment.

After all this process HSBC used to put all this information into their software which is known as offline process. They mainly follow this process because this is helpful for them and it used make the process easier to report to Bangladesh bank. They used to put all this information into a form. After that they used to keep all the documents to themselves. They used to keep a record and after the particular period they used to prepare a report and send the report to Bangladesh Bank. The people from Bangladesh bank also used to come to audit the system of this L/C reporting and to verify if their report is ok or not. This was a hassle for Bangladesh bank because to verify this reporting system they had to go to every bank and had to verify the process as well as the reports. So to get rid of the process they introduced a new automated system.

Automated L/C system

The automated L/C system has created a revolutionary change into the L/C system. Though because of this system different baking organization had to face different difficulties but in the long term the whole industry will enjoy the benefits of this system. The automated L/C system consisted of different parts

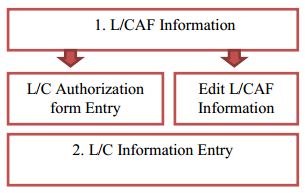

1. L/C (Letter of Credit) opening (Automation)

This step was mainly divided into two parts. The first part was posting L/CAF information. Under the L/CAF information there were two parts. One was L/C authorization form entry another one was edit L/CAF information. The Second part of this step was L/C information entry. The steps are:

i) LCAF Information

a) L/C Authorization Form Entry

In this part I had to put information about LCA no, LCA date, Imp reg no, importer, import commodity type, currency code, LCA value, LCAF type, Import type. I used to collect all these information from the files. The information are scattered in the file. I had to accumulate them and then put the information manually. These information are very important. The most important information are the LCA no, imp reg no and LCA value. These are important because if there is any mistake this will create problem in other steps. This means if I provide wrong information then I will face problem in posting IMP information and Bill of entry information later on. If I put the information accurately then I will get a LCAF number which I had to use afterwards. I had to write the LCAF number in the file. After getting the LFAC number I had to put it on the search option and then all the information will appear again and later I had to put information regarding commodities. This included putting information about commodity code, commodity, unit code and quantity. After I used to click the create button.

b) Edit LCAF

This was an essential option as it helped to edit the information in LCAF authorization form if there were any mistakes. I just had to collect the LCAF number from the file which I previously wrote and had to type it in the search option and then all the information regarding the LCAF used to appear.

ii) L/C Information Entry

In this part I used to put all the information regarding LCAF id, L/C no, L/C date, Country of origin, Destination country, Incoterm used, L/C type, L/C expiry date, L/C expiry place, L/C amount, Partial shipment allowed, Transshipment allowed, Last shipment date. All these information were present in the file. I had to perform this task very carefully because the information were very important and sometimes the information were absent and I had to find those information on my own. It was a difficult task for me. After that I had to click the create option. Then the system used to provide me a L/C id number. Later I had to put information in L/C items detail and had to click create option. After all these have to enter Price and Quantity in the L/C Item Details Form. In item detail form the unit price and quantity needs to be in such a manner so that the total value does not exceed the original L/C value. If it exceeds then error message will appear after doing this the whole process of opening L/C is finished. L/C opening work has to be done carefully though the work is a bit monotonous. To put information online there are some papers which are important. There is an industrial paper, amendment paper etc from which I used to collect information. There is higher chance of error as I had to go through different papers.

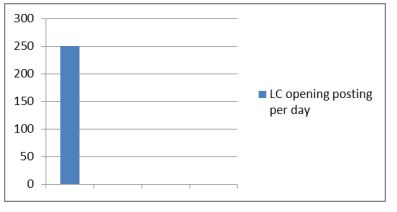

The number of posting LC opening information per day on average is 250. The number of posting mainly depends on the people available and their skill. Besides availability of files is another issue.

2. IMP (Import Payment) Information

For IMP information entry I had to put the IMP serial, L/C id, imp amount, port export, invoice number, invoice amount, ship port, and vessel name. After putting all the information I had to click create. Afterwards the system will provide me an imp serial number which I had to write in the file. The IMP serial had to be a unique number.

To put information regarding this project the information I used to take from commercial invoice, bill of lading paper, airway bill, pro-forma invoice etc. This work is very important because bill of entry is related with it. Later on there is a step in bill of entry where I had to match bill of entry with the IMP number.

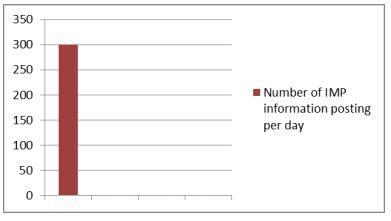

The number of IMP posting per day in HSBC on average is 300. If the people are skilled then number of posting is higher as they can easily post the information.

3. Bill of Entry

Bill of entry is the last procedure of L/C. While posting bill of entry I had to perform another task which was sorting. At first I had to sort out the bill of entry. I had to sort because the bill of entry of different customers was together so at first I had to separate them afterwards I had to post the data. Bill of entry posting procedure was different from opening and IMP posting. After sorting I had to match the L/C number with an excel file. After matching I had to find out the L/C id number and then had to put the number into bill on entry page and then had to press the tab button. Afterwards the L/C date and bill of entry amount will appear automatically. Later I had to click create and had to write the id into the bill of entry page. Then I had to put the information about commodity code, unit price unit and quantity. Finally I had to match the bill of entry with an IMP and had to write the IMP number in the bill of entry page. This was the whole procedure of Bill of Entry posting.

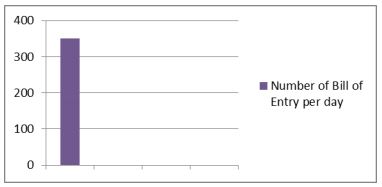

The number of bill of entry per day on average is 350. Employees, interns try their best to maintain this line. Sometimes they cross the line and post more than 350 bill of entries.

4. Bill of Entry Overdue

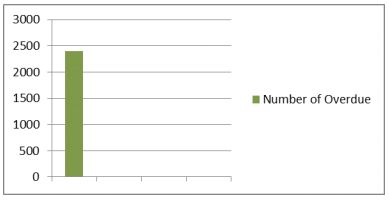

In the last month of my internship my supervisor made a team of 6 people to post bill of entry overdue information. Overdue means that the customer has made the payment but the information about that bill of entry has not posted yet on Bangladesh Bank website. Those customers won‟t be able to open further L/C unless their overdue bill of entry information is posted. So we as a team tried to reduce the number of that overdue bill of entries.

The number of overdue right now is approximately 2400. Right now the main focus of HSBC is to lessen this overdue number. Without lessening this amount they won‟t be able to serve their clients appropriately. Shifting from the manual process to the automated process was not an easy task for HSBC or any other organization. As the organization got used to work in manual process to shift to automation they had to create a whole new strategy. Shifting to automation was tough but they managed it well because they were organized. The permanent employees over there are skilled.

HSBC Coping with new automation system

At first they run the automation program on a trial basis. They did this to make their employees get used to it and to find out what problems they are facing. To cope up with the new system HSBC hired more contractual employees. Besides, they also hired a lot of interns. They used to send their employees to the training programs where the employees learnt different lesson of this automation system. At first the permanent employees attended the trainings and learnt how to handle the system. After they became skilled they taught the contractual employees how to deal with the system. Finally the contractual employees helped the interns how to cope with the system. Many errors occurred but they still motivated their employees, taught the employees how to deal with errors.

Comments